Tax calculation

The Billingbooth One platform offers two different mechanisms for calculating tax on an invoice. There are pros and cons to each approach, this article discusses the different aspects to help you choose the best method for you.

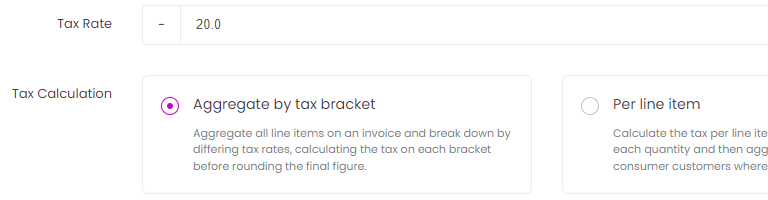

The tax calculation method is configured on a per-organisation basis, and can be found when editing an organisation, under the Invoicing tab on the Financial heading:

Aggregate by tax bracket

Using this method, Billingbooth will look at all the line items on an invoice, then aggregate each of those line items by the different tax brackets, finally working out the tax from the aggregate sum of the totals within each bracket. For example:

| Description | Quantity | Unit Price | Tax Rate |

|---|---|---|---|

| Broadband Line | 1 | 29.99 | 20% |

| Mobile SIM bundle | 1 | 10.00 | 20% |

| Data outside of bundle | 1250 | 0.23 | 20% |

| Special charge | 5 | 5.99 | 5% |

The aggregate by tax bracket will effectively sum all unit price x quantity for tax rate 20%, then sum all unit price x quantity for tax rate 5%, and work out the tax, to 2 decimal places, for each bracket. The calculation for tax eventually turns into:

| Tax Rate | Total Amount | Tax Due |

|---|---|---|

| 20% | 327.49 | 65.50 |

| 5% | 29.95 | 1.50 |

Invoice Sub-Total: 357.44

Total Tax: 67.00

Invoice Total: 424.44

Per line item

The per line item calculation mechanism takes a more granular approach to working out tax. Billingbooth will automatically calculate a unit tax value (to 2 decimal places) on each line item, based on that line items's tax rate. For example:

| Description | Quantity | Unit Price | Tax Rate | Unit Tax |

|---|---|---|---|---|

| Broadband Line | 1 | 29.99 | 20% | 6.00 |

| Mobile SIM bundle | 1 | 10.00 | 20% | 2.00 |

| Data outside of bundle | 1250 | 0.23 | 20% | 0.05 |

| Special charge | 5 | 5.99 | 5% | 0.30 |

Billingbooth will iterate through each line, and mulitply the line item's unit tax by the quantity, then aggregate the totals to work out the overall invoice tax. The calculation for tax eventually turns into:

| Description | Quantity | Unit Tax | Total Tax |

|---|---|---|---|

| Broadband Line | 1 | 6.00 | 6.00 |

| Mobile SIM bundle | 1 | 2.00 | 2.00 |

| Data outside of bundle | 1250 | 0.05 | 62.50 |

| Special charge | 5 | 0.30 | 1.50 |

Invoice Sub-Total: 357.44

Total Tax: 72.00

Invoice Total: 429.44

Pros and Cons

TIP

As a rule of thumb, and as a default for new accounts, we recommend using Aggregate by tax bracket as the tax calculation method.

You can see by comparing the two calculation methods and the resulting total tax that there is a significant difference between the two methods. The culprit in this instance is the Data outside of bundle charge. In the Per line item calculation method, the line item's unit price is 0.23, with a tax rate of 20%, meaning that the actual tax amount for a single quantity is (0.23 / 100) x 20 = 0.046 but because we calculate all billable figures to two decimal places, this is then stored as 0.05. The rounding up of this figure, mulitplied by the number of times this gets done (1250 in this line) means that the disparity in overall tax is more obvious.

The one scenario where Per line item works in the account holder's favour is when trying to bill tax-inclusive amounts that are tricky to reach to.

An example of this would be to try and sell a broadband line for 24.99 inclusive of tax. It's not technically possible to reach such an amount when adding a charge exclusive of tax:

| Unit Price | Tax Rate | Unit Tax | Rounded 2DP | Total Charge |

|---|---|---|---|---|

| 20.82 | 20% | 4.164 | 4.16 | 24.98 |

| 20.83 | 20% | 4.166 | 4.17 | 25.00 |

To achieve an exact price inclusive of tax, Billingbooth has the charge-specific option Sell Price is inclusive of Tax which then slightly tweaks the final line item unit tax to ensure that unit amount + unit tax add up to the inclusive price originally specified. Using Sell Price is inclusive of Tax will generate the following:

| Unit Price | Tax Rate | Unit Tax | Total Charge |

|---|---|---|---|

| 20.82 | 20% | 4.17 | 24.99 |

If the invoice was to contain only the above charge, Per line item calculation mechanism would need to be used to pick up the line item's pre-calculated unit tax figure, otherwise if calculations were done using Agregate by tax bracket then the same problem would apply as per the previous example and the invoice total would end up being 24.98.