Configuring GoCardless

Linking your GoCardless account

The first thing you will need to do, is link your GoCardless account to Billingbooth.

To do this, navigate to the Payment Settings screen, simply click on the Settings menu item in the left-hand main navigation and click the Payments link under the General menu heading.

Once there, click the Add Payment Provider button at the top-right.

This will take you to the Add New Payment Provider screen.

Select GoCardless from the Provider drop-down menu and then click the Next button to proceed.

On the Connect to GoCardless screen, clicking the Finalise button will redirect you to GoCardless, where you can enter your GoCardless credentials and request your authorisation to link your account.

Once the process is complete it will return you to Billingbooth's payment screen where you should see a confirmation appear, informing you that your account is now linked.

GoCardless payment settings

Once set up, if you click the Edit Integration button of the GoCardless payment provider listing, found in the Actions column, you will have a range of options available to you.

| Field | Description |

|---|---|

| Description (Optional) | A means of differentiating between other GoCardless integrations you may have set up on Billingbooth. |

| Collection mode | How the payment will be collected after issuing an invoice: Automatic, after issuing invoice - Collect the payment automatically. Manual - Collect the payment by heading to the Invoices screen and clicking the respective Payments action for an invoice. |

| Payment date | When you would like the payment to be taken: Collect relative to invoice issue date - Collect payments X days after the invoice issue date. Where X equals the value supplied in the Collect after field below. Collect on a fixed day - Collect payments on a fixed day of the month, specified in the Day of the month field below, regardless of invoice issue date. |

| Collect after (if Automatic, after issuing invoice and Collect relative to invoice issue date are selected) | The value you enter here will detirmine how many days after issuing an invoice GoCardless will wait before taking payment. For example, entering 14 will see payment taken automatically, 14 days after the invoice(s) have been issued. |

| Day of the month (if Automatic, after issuing invoice and Collect on a fixed day are selected) | The value you enter here will detirmine which day of the month GoCardless will take a payment. It should be noted that GoCardless themselves require at least 3 days to process payments, as such, issuing an invoice less than 3 days before your Day of the month value will likely result in a payment being taken later on. |

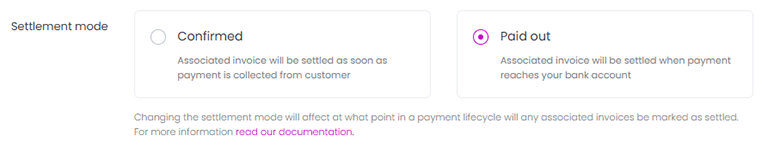

| Settlement mode | Configures what payment status (confirmed or paid out) triggers the settlement of associated invoices. See more information about settlement mode. |

| Automatic retry | If a payment fails, typically due to insufficient funds, having this field checked will have Billingbooth retry taking the payment up to three times. Each retry will typically take 2-3 working days as it submits, fails, then submits again etc.. |

| Support Success+ | If checked, Billingbooth will enable support for Success+ payments which allow for intelligent retry. See more information about enabling Success+. |

| Force fixed day | If GoCardless' minimum charge date is less than the specified fixed day, Billingbooth will push the payment to the fixed day in the following month. |

| Email notifications | GoCardless event notifications such as new mandate sign ups, mandate removed or payments failed can be emailed. |

| Notification address (if Email notification checked) | The address to send GoCardless payment notifications to. If you wish to enter multiple email addresses, separate them with a comma (,). |

Overriding Automatic Collection Period

There could be instances where you wish to have a different automatic collection period set for one or more customers that differs from your global automatic collection period settings (as above).

To accomplish this, you can head to Customers in the side-navigation and then Customers, select the customer, and then in the top navigation menu, click Configuration > Payment Methods.

From the Payment Methods screen, for payment method already listed, you're able to click the value in the Automatic Collection Period column to open an Edit modal. This lets you specify the exact collection period you'd like for this customer.

If you ever wish to set it back to the default global behaviour, simply open the Automatic Collection Period Edit modal and click the Remove button.

Enabling Success+

Billingboooth supports the GoCardless Success+ feature which allows for intelligent retries on failed payments.

In order to enable this feature, the following actions need to be taken:

- In the GoCardless portal, head over to the Success+ configuration page, and enable Success+ for the relevant currency. In this page you can configure how Success+ behaves with options such as the retry period and the number of retry attempts.

- In the Billingbooth portal, under Settings -> Payments -> GoCardless, check the Support Success+ checkbox.

Once the two options above have been enabled, Billingbooth will automatically push new payments to GoCardless with the Success+ feature enabled, meaning that any failed payments due to insufficient funds will be retried intelligently.

!> If Support Success+ is enabled in Billingbooth, all retry logic will be handled by GoCardless and not Billingbooth, even if Automatic retry is enabled.

Settlement mode

GoCardless payments have a lifecycle that lasts roughly three working days. Once this payment has been collected, and depending on your agreement with GoCardless, that payment then has a further day or two before it reaches your bank account.

By default, Billingbooth will mark any invoices associated to the payment as Settled once GoCardless has paid out the collected amount to your bank account. This is known as the Paid out settlement mode.

If you would prefer to have the invoices settled once GoCardless has collected the payment from the customer (but before it gets paid out into your bank account), you can change the settlement mode to Confirmed. This will speed up the settling of the invoice within Billingbooth along with its reflected status in things like the customer access portal.

!> Whilst Billingbooth will reverse a settled invoice if payment failure ultimately occurs, regardless of whichever settlement mode is configured, choosing Paid out will reduce the chance of things like missed overdue email reminders and is generally the recommended settlement mode.