What are customer balances?

Each customer can be treated as an individual account, with a full history of credits and debits that total the current outstanding balance of that customer.

Each time an invoice is issued, a new debit is added onto the customer's account to the total invoice amount. Each time that a payment is taken, or each time an invoice is settled manually using one of a range of types available, a credit is added onto the customer's account.

Adding each credit and debit on a customer's account brings together the total amount of that customer's account, which either puts the customer in credit or in debit to you.

How does this affect behaviour?

The standard model that the platform follows is that an invoice gets issued, and if the customer is appropriately configured, a payment for the amount of that invoice is also submitted. This model does not take into account any previous outstanding debt or history, it will always be treated as a single transaction for a single fixed amount.

With customer balances, Billingbooth can be configured to alter its behaviour in one of two ways:

Invoices use previous balance

In a standard invoice, the invoice summary contains three simple pieces of information: Amount, Tax, Total:

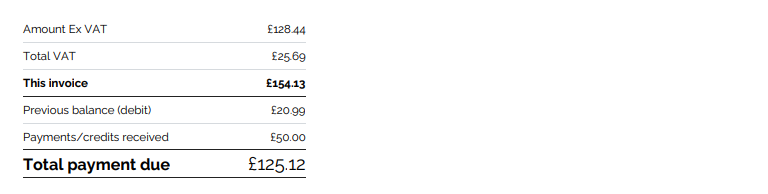

By enabling Invoices use previous balance, the invoice total changes to a more statement-like format:

In addition to Amount, Tax and Invoice Total, the previous balance at the time of the last invoice (or if this is the first invoice, the opening balance) is displayed, along with any payments or credits received since, as well as any additional debits such as manual adjustments. Finally, at the bottom, the Total payment due is displayed which is a combination of the previous balance, credits and debits received, and the total for the current invoice.

Payments use previous balance

When a billing run is issued, the standard model of the platform, if a payment method is configured, is to take a payment for the amount of the invoice issued (invoice amount + tax)

Enabling Payments use previous balance will change the way the payment amounts are calculated based on a number of factors:

Previous outstanding debt

If the customer holds some previous debt on the account, such as an invoice that is still outstanding, or a manual debit has been added onto their account which puts them into debt, the payment amount issued during a billing run will cover the total amount for the newly-issued invoice as well as the previous outstanding debt.

Pending payments

When calculating the required payment amount for outstanding debt, existing pending payments will be taken account so if a pending payment exists that covers outstanding debt, the newly issued payment will not include that amount in its calculation.

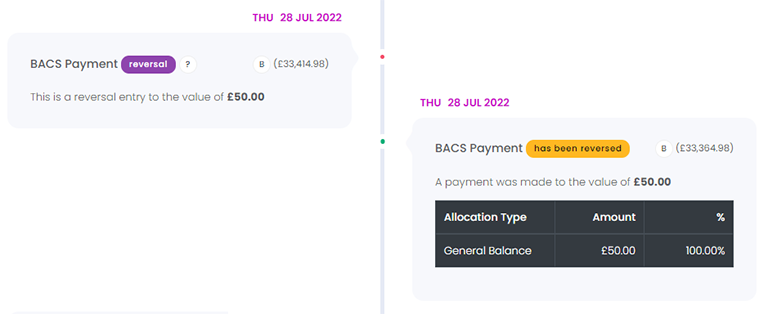

Reversed balance entries or voided invoices

Balance entries that have been reversed will automatically cancel out any debit/credit, and any voided invoices will also have their amounts reversed. In both of these scenarios they effectively get ignored when working out payment calculations.

WARNING

If you are not planning on using the platform to reconcile your invoices, by settling them on a regular basis manually or automatically through payment providers then you should not enable customer balance options as this will lead to payments being wrong in the future due to unsettled invoices.

How do I cancel bad debt?

In cases where an invoice has been settled incorrectly or erroneously, setting an invoice to Outstanding will automatically reverse all necessary entries. Likewise, setting an invoice to void will reverse the debt created by that invoice.

If a post adjustment has been made in error, this can be reversed in the customer's balance page by clicking on the Reverse action. Please note that if the post adjustment's type is not reversible, it will not be possible to reverse the posting. See Configuration for more details.

Reversing an entry will create an opposing entry, effectively voiding the value of the original entry.